nebraska inheritance tax worksheet 2021

Brian and Joe as Class 1 beneficiaries will pay a 1 percent tax on 160000 less applicable deductions 200000 40000 exemption. 12 Pics about Tax Prep Worksheet 2018 Universal Network.

Nebraska Estate Tax Everything You Need To Know Smartasset

Her estate is worth 250000.

. In other words they dont. Nebraska Inheritance Tax Worksheet TUTOREORG - Master Of. Certificate of mailing annual budget reporting forms.

The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly. Up to 25 cash back Close relatives pay 1 tax after 40000. Open the document in the full-fledged online editor by hitting Get form.

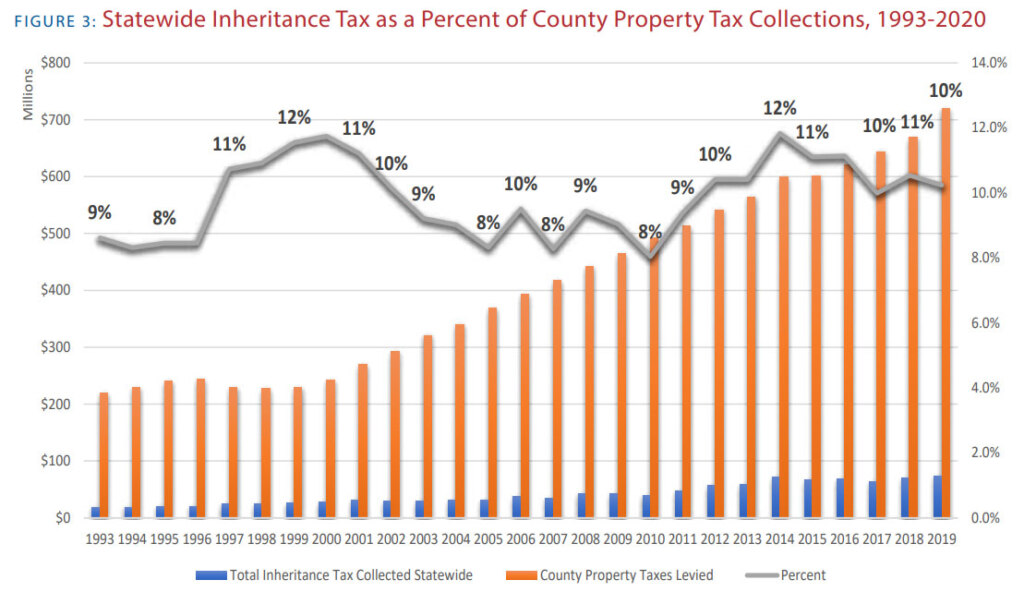

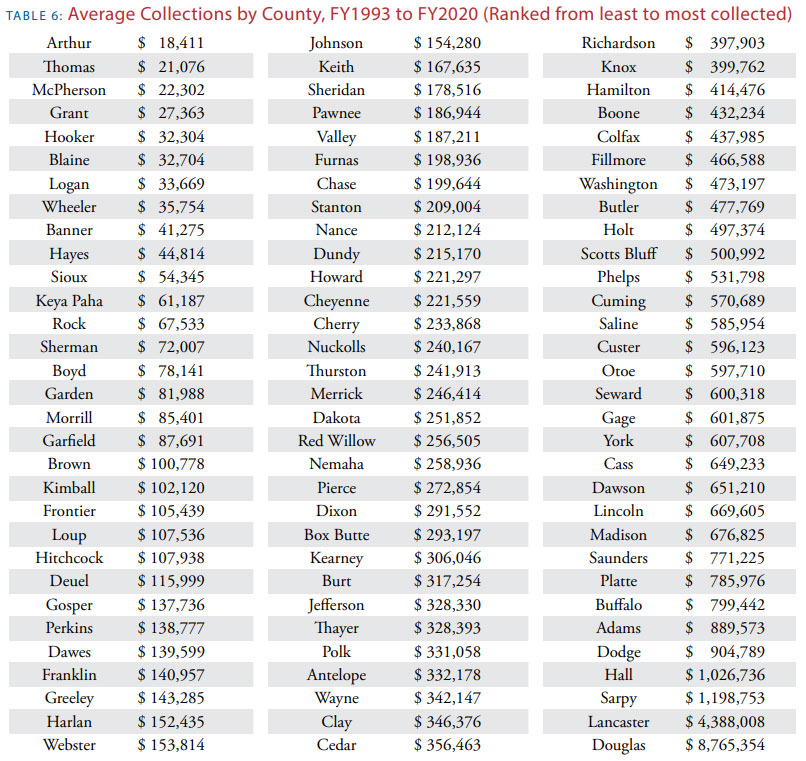

402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098. Practice your Addition Subtraction Mutliplication and Division - self-marking Online exercises. On a statewide basis inheritance tax collections in Nebraska have ranged from a 189 to 733 million since 1993 337 to 745 million if adjusted for inflation into 2020 dollars.

Tax Prep Worksheet 2018 Universal Network. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. Add the nebraska inheritance tax worksheet form for editing.

Sign in to the editor with your credentials or click Create free account to evaluate the tools functionality. Practice worksheets to help your child to learn their basic math facts. Nebraska Inheritance Tax Worksheet Resume.

Suite 200 Lincoln NE. Preparation of the Key Stage 2 Grades 4-6 and Key Stage 3 Junior HS and Key Stage. Beneficiaries inheriting property pay an inheritance tax over.

36 Nebraska Inheritance Tax Worksheet - Worksheet Source 2021. The fair market value is the present value as. You are a first-time filer for Nebraska income tax purposes.

Nebraska Inheritance Tax Worksheet 2021. Or total income tax. Nebraska State Bar Association 635 S.

Nebraska income tax return was or would have been had you been required to file for a full 12 months. Nebraska inheritance tax is computed on the fair market value of annuities life estates terms for years remainders and reversionary interests. In some estates this may require appraisals.

These activity sheetsworksheets are made for the 1st quarter of this school year in GRADE 1. An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

Property at the date of death. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Bob a Class 2 beneficiary will pay a.

Nebraska Tobacco Products Tax Return for Products Other than Cigarettes 122019 56. Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet 36. Nebraska Tax Application and Return for Mechanical Amusement Device 052018 54.

Does Nebraska Have An Inheritance Tax Hightower Reff Law

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

Comprehensive Estate Planning White Paper

Nebraska Forms Nebraska Department Of Revenue

Death And Taxes Nebraska S Inheritance Tax

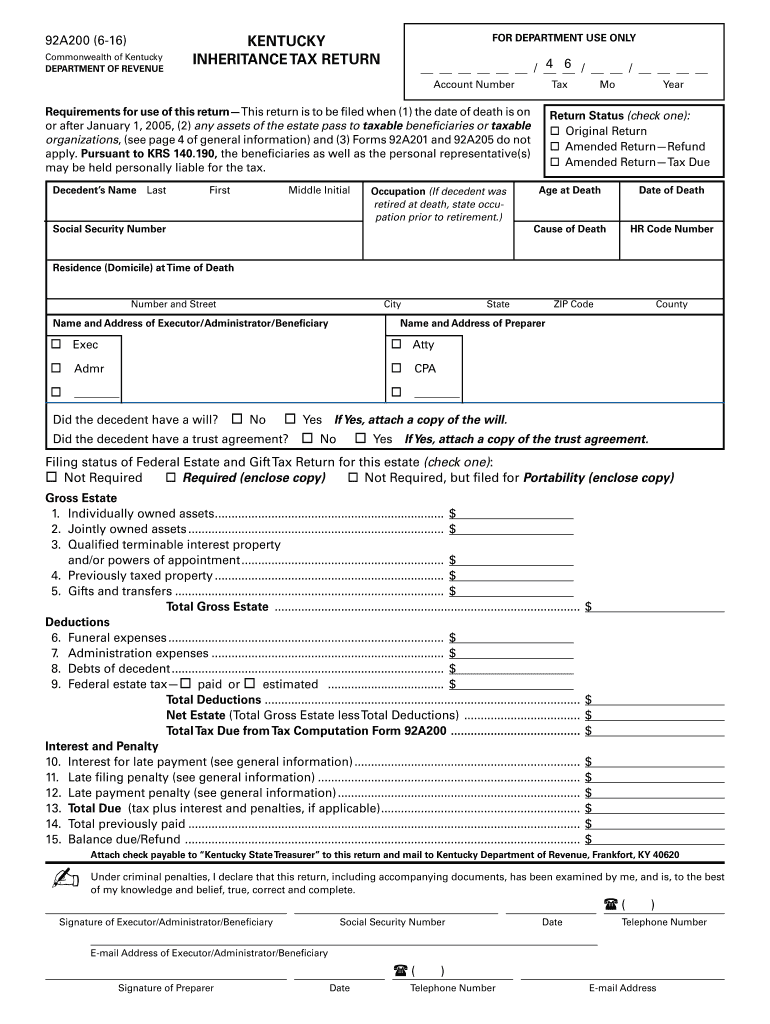

Form 92a200 Fill Out Sign Online Dochub

Death And Taxes Nebraska S Inheritance Tax

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Estate Planning Part One Of A Lifelong Journey Rdg Partners

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Death And Taxes Nebraska S Inheritance Tax

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Nebraska Forms Nebraska Department Of Revenue

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities